What Is The Sales Tax Rate On Used Cars In Illinois . the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. There is also between a 0.25% and 0.75% when it comes. For example, sales tax on a car might be different.

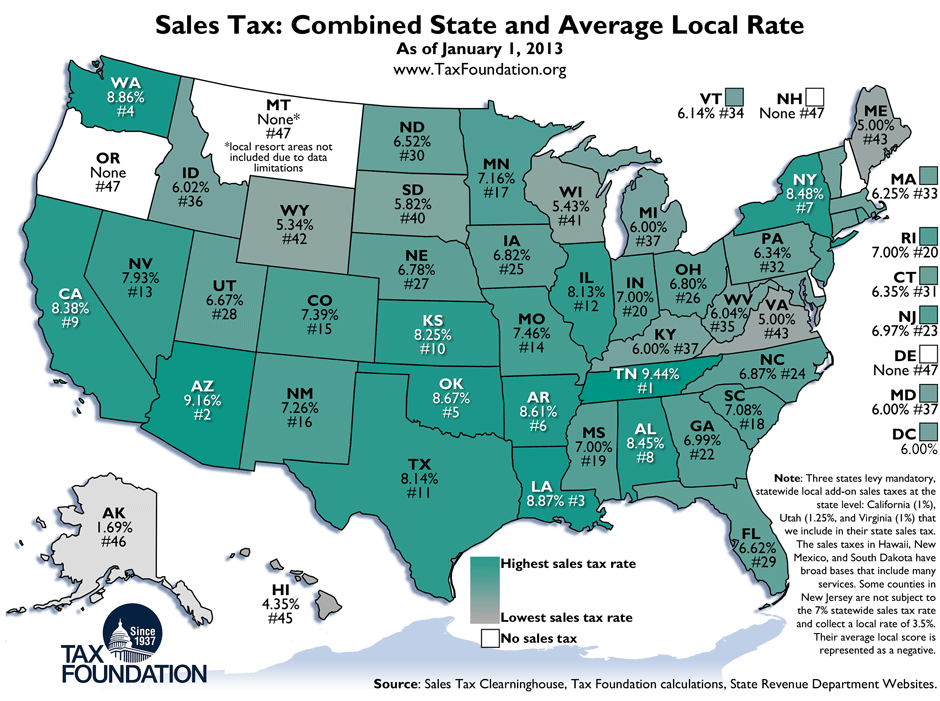

from taxfoundation.org

illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between a 0.25% and 0.75% when it comes. For example, sales tax on a car might be different. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles.

Weekly Map State and Local Sales Tax Rates, 2013 Tax Foundation

What Is The Sales Tax Rate On Used Cars In Illinois illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. For example, sales tax on a car might be different. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between a 0.25% and 0.75% when it comes.

From aprilqkimbra.pages.dev

Illinois State Sales Tax Rate 2024 Devan Fenelia What Is The Sales Tax Rate On Used Cars In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. For example,. What Is The Sales Tax Rate On Used Cars In Illinois.

From exoeuuaoq.blob.core.windows.net

What Is The Sales Tax Rate On A Vehicle In Louisiana at Francis Vasquez What Is The Sales Tax Rate On Used Cars In Illinois illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. For example, sales tax on a car. What Is The Sales Tax Rate On Used Cars In Illinois.

From exomfrilj.blob.core.windows.net

Sales Tax Rate For Car In Missouri at Alfred Crocker blog What Is The Sales Tax Rate On Used Cars In Illinois illinois car sales tax impacts how consumers in illinois are charged for their vehicles. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. . What Is The Sales Tax Rate On Used Cars In Illinois.

From rkmillerassociates.com

Sales Tax Expert Consultants Sales Tax Rates by State State and Local What Is The Sales Tax Rate On Used Cars In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between a 0.25% and 0.75% when it comes. the tax is imposed on. What Is The Sales Tax Rate On Used Cars In Illinois.

From quizzdbbackovnc.z13.web.core.windows.net

State And Local Sales Tax Rates 2020 What Is The Sales Tax Rate On Used Cars In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. There is also between a 0.25% and 0.75% when it comes. For example, sales tax on a car might be different. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party. What Is The Sales Tax Rate On Used Cars In Illinois.

From www.fbasalestax.com

US Sales Tax Rate Map The FBA Sales Tax Guide What Is The Sales Tax Rate On Used Cars In Illinois illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the. What Is The Sales Tax Rate On Used Cars In Illinois.

From quizzdbbackovnc.z13.web.core.windows.net

State And Local Sales Tax Rates 2020 What Is The Sales Tax Rate On Used Cars In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. . What Is The Sales Tax Rate On Used Cars In Illinois.

From exoyenypj.blob.core.windows.net

Car Sales Tax Rate Missouri at Adam Baxter blog What Is The Sales Tax Rate On Used Cars In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between a 0.25% and 0.75% when it comes. For example, sales tax on a car might be different. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase. What Is The Sales Tax Rate On Used Cars In Illinois.

From 2016carreleasedate.com

The Amount Listed In The Sales Tax Table For Other States Click Here What Is The Sales Tax Rate On Used Cars In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another. What Is The Sales Tax Rate On Used Cars In Illinois.

From dinosenglish.edu.vn

Álbumes 103+ Foto Que Es El Tax Id En Estados Unidos Actualizar What Is The Sales Tax Rate On Used Cars In Illinois There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. For example, sales tax on a car might be different. the statewide. What Is The Sales Tax Rate On Used Cars In Illinois.

From www.yo-kart.com

Sales Tax Automation In Marketplaces With TaxJar And Avalara What Is The Sales Tax Rate On Used Cars In Illinois There is also between a 0.25% and 0.75% when it comes. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or. What Is The Sales Tax Rate On Used Cars In Illinois.

From www.cars24.com

GST Rate on Used Cars How much Tax applies on Used Cars? What Is The Sales Tax Rate On Used Cars In Illinois There is also between a 0.25% and 0.75% when it comes. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. For example, sales tax on a car might be different. illinois private party vehicle use tax is based on the purchase price (or fair market. What Is The Sales Tax Rate On Used Cars In Illinois.

From www.mapsofworld.com

What is the Combined State and Local Sales Tax Rate in Each US State What Is The Sales Tax Rate On Used Cars In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or. What Is The Sales Tax Rate On Used Cars In Illinois.

From www.jacksonville.com

States with the highest and lowest sales taxes What Is The Sales Tax Rate On Used Cars In Illinois For example, sales tax on a car might be different. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. There is also between a 0.25% and 0.75% when it comes. illinois private party. What Is The Sales Tax Rate On Used Cars In Illinois.

From exoxyqeqj.blob.core.windows.net

Sales Tax Rate On Cars In Utah at Donna Caceres blog What Is The Sales Tax Rate On Used Cars In Illinois illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. There is. What Is The Sales Tax Rate On Used Cars In Illinois.

From exozhhwmx.blob.core.windows.net

Used Car Illinois Sales Tax at Terry Shuler blog What Is The Sales Tax Rate On Used Cars In Illinois For example, sales tax on a car might be different. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between. What Is The Sales Tax Rate On Used Cars In Illinois.

From www.patriotsoftware.com

Managing Your Sales Tax Rates What Is The Sales Tax Rate On Used Cars In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois. What Is The Sales Tax Rate On Used Cars In Illinois.

From exoocrxzc.blob.core.windows.net

Used Car Sales Tax Rate at Jean blog What Is The Sales Tax Rate On Used Cars In Illinois For example, sales tax on a car might be different. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or. What Is The Sales Tax Rate On Used Cars In Illinois.